Enhancing Restaurant Efficiency with Real-Time PCI Compliance

- Phone: +1(833)PHX-Geek

- 712 H St NE Suite 1904 Washington, D.C. 20002

Take a look at our camera system. Get remote access to your cameras, and monitor your restaurant while you are away. Great protection for you from theft, employee grift and wrongful lawsuits.

Introduction

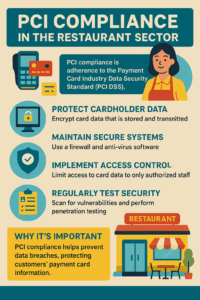

Payment Card Industry (PCI) Compliance is vital for any restaurant handling card payments. It ensures that sensitive customer data is protected, reducing the risk of data breaches and fraud. In an industry where customer trust is paramount, maintaining PCI compliance not only protects the restaurant but also enhances its reputation. Understanding the nuances of PCI compliance is essential for restaurant owners who aim to safeguard their business and clientele.

Restaurants often face unique challenges regarding PCI compliance due to the fast-paced nature of their operations. From point-of-sale systems to online ordering platforms, multiple channels require adherence to stringent security standards. Failure to comply can lead to hefty fines and damage to brand credibility. Thus, implementing robust PCI compliance measures is crucial for any restaurant that accepts credit and debit card transactions.

Moreover, keeping up with PCI compliance requirements can seem daunting. However, with the right approach and resources, restaurants can not only comply but also turn it into a competitive advantage. By fostering a secure payment environment, restaurants can enhance customer loyalty and drive repeat business, ultimately boosting their bottom line.

Real-time monitoring is becoming increasingly important in the restaurant industry, especially concerning PCI compliance. By employing advanced technologies, restaurants can track and manage compliance requirements continuously. This proactive approach allows for immediate detection of potential vulnerabilities, ensuring that any issues are addressed promptly before they escalate into serious problems.

Integrating real-time monitoring systems helps streamline operations. For instance, if a vulnerability is detected in the payment processing systems, immediate alerts can prompt a quick response. This minimizes downtime and enables restaurant staff to focus on providing exceptional service rather than worrying about compliance issues. Furthermore, such systems can automate reporting processes, saving valuable time and reducing the risk of human error.

The efficiency gained through real-time monitoring also extends to staff training and awareness. Employees are more likely to adhere to compliance protocols when they see tangible evidence of their importance. By fostering a culture of security through continuous monitoring, restaurants can enhance overall efficiency and performance.

Streamlining PCI compliance processes can lead to significant operational efficiencies in restaurants. By simplifying the compliance framework, restaurants can reduce the time and resources spent on manual compliance checks. This not only frees up staff to focus on customer service but also allows them to concentrate on core business functions.

Streamlining PCI compliance processes can lead to significant operational efficiencies in restaurants. By simplifying the compliance framework, restaurants can reduce the time and resources spent on manual compliance checks. This not only frees up staff to focus on customer service but also allows them to concentrate on core business functions.

One of the most significant benefits of streamlined processes is cost reduction. Automated compliance management tools can minimize the need for extensive manual audits and oversight. This leads to lower operational costs and improved cash flow, allowing restaurants to reinvest savings into enhancing customer experiences or expanding their offerings.

Additionally, a well-structured compliance process can minimize risks associated with data breaches. By ensuring that all systems are consistently up to date with PCI standards, restaurants can mitigate the likelihood of costly security incidents. This not only protects the restaurant’s bottom line but also strengthens its reputation in a competitive market.

As technology continues to evolve, so too do the trends in PCI compliance within the restaurant sector. One significant trend is the increasing reliance on artificial intelligence (AI) and machine learning. These technologies can analyze transaction data in real-time, identifying suspicious activities that may indicate fraudulent behavior. This proactive security measure enhances compliance while also improving customer trust.

Another emerging trend is the integration of mobile payment solutions. With more customers opting for contactless payments, restaurants must ensure that their PCI compliance strategies are compatible with these technologies. This shift requires an agile approach to compliance management, allowing restaurants to adapt quickly to new payment methods while safeguarding customer data.

Finally, collaboration among industry stakeholders is expected to grow. By sharing best practices and insights about PCI compliance, restaurants can collectively improve their security measures. This collaborative approach will not only enhance individual restaurant operations but also elevate industry standards as a whole, fostering a safer dining environment for everyone.

Conclusion

In conclusion, the integration of real-time PCI compliance steps significantly boosts restaurant efficiency. By understanding and implementing these compliance measures, restaurants can protect their customers, streamline operations, and enhance their overall performance.